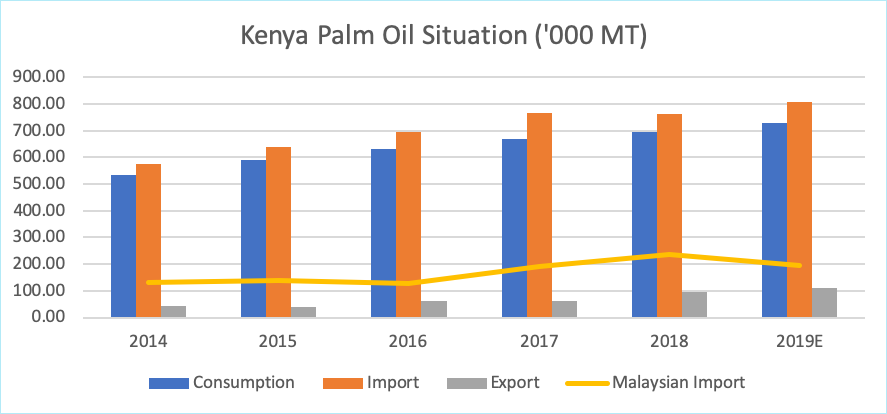

On 8 April 2020, Kenyan President Uhuru Kenyatta has announced a 21-day restricted movement orders in Nairobi, Mombasa, Kilifi, and Kwale in its effort to combat COVID 19 spread and has since extended the order until further notice. Fortunately, the movement of food supplies and other essential cargos will continue as normal during the restricted movement period. The economic impact of the restricted movement order is felt across the country especially the lower-income population in Nairobi and Mombasa who relies heavily on informal jobs are severely affected with little to no income. In addition, there is an ongoing desert locust invasion in Kenya that affected food producing crops in the country such as rice, maize, irish potatoes, and wheat. In view of this, the Kenyan Government has initiated a food aid programme to distribute food to the lower-income population in the affected regions. Kenya, a major consumer of palm oil in Sub-Saharan Africa with a consumption of 787,600 MT of oils and fats. The country relies heavily on oils and fats imports due to its estimated local production of sunflower and cotton oil totalling only 3,400 MT in 2019. Palm oil held an estimated market share of 92.7% of the total oils and fats consumption in Kenya. In the same period, Kenya imported a total of 808,700 MT and exported a total of 110,100 MT of palm oil. Malaysia held an import share of 24% or 193,340 MT in 2019.

Source: Oilworld, MPOB, MPOC estimates

Kenya is a major CPO importer, attributed to its preferential tariff at 10% compared to PPO at 25%. Another reason for the major market share in CPO in Kenya is because Kenya imposes food fortification logo and certification policy towards vegetable oils and fats containing Vitamin A and this has led to difficulty in port clearing. The policy has caused RBD Olein import share in Kenya to drop significantly and local industry members have shifted to the importation of CPO instead for local processing to comply with the local policies. In 2019, Kenya imported a total of 150,673 MT of Malaysian CPO, an increase of 20% compared to the previous year at 120,738 MT. Malaysian import share of CPO and PPO into Kenya is at 79.2% and 20.8% respectively. In the upcoming months, Kenya is expected to increase its CPO imports as the current stocks are being consumed rapidly.

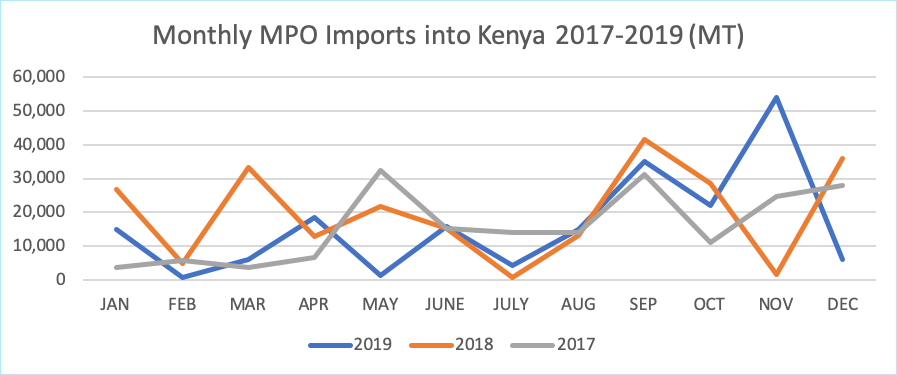

Source: MPOB

From the graph above, the first half of the year shows a slow trend in imports due to the steady supply of palm oil stocks. However, in the second half of the year, major restocking activity occurs and lasts from July to December, especially in the month of September as a result of the sunflower planting season in Tanzania during the same period, in which the country relies on palm oil imports from Kenya to satisfy its immediate demand. December 2019 imports dropped drastically due to overstocking in the previous month.

| (MT) | Jan | Feb | Mar | April | Jan-Apr |

| 2020 | 6,776 | 12,765 | 8,099 | 29,269 | 56,910 |

| 2019 | 14,878 | 566 | 6,110 | 18,387 | 39,941 |

Table 1: Q1 MPO Imports into Kenya

Source: MPOB

January-April 2020 MPO imports into Kenya recorded an increase of 30% compared to the same period of the previous year. This increase is attributed to the major stocking activities in anticipation of supply disruption from COVID 19. It is important to note that major restocking activities occur in the 2nd half of the year as shown in Figure 2 due to increased demand from neighbouring countries.

In view of this, Kenya will experience a surge in food demand that may force local industry members to increase their imports in the upcoming months as palm oil stocks dwindle. The reason for the increase in consumption is the Kenyan Government has initiated a food aid programme to supply food and relief for the lower-income population that are affected by COVID-19 and desert locust invasion. The programme may see an increase in demand of household items such cooking oil, ready-to-eat meals, bakery, and confectionery products as part of the Government’s effort. Despite this, HORECA industry members may stay on the side-line to monitor the COVID-19 situation before ascertaining the full impact of the pandemic on their industry as lockdowns in major cities negatively affects their operations.

Weakening Kenyan Shillings may pose a challenge towards the country’s buying behaviour. Nevertheless, the Kenyan Government’s food aid programme and ongoing desert locust invasion is expected to help increase the demand for palm oil into the region as food demand has outweighed the supply. A small drop in bulk buying in the HORECA sector is expected as the industry may stay on the side-line to monitor the current situation. Thus, with the increase in consumption coupled with dwindling palm oil stocks, Kenya is expected to increase its imports in the upcoming months.

Prepared by Fazari Radzi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.